June 28, 2010

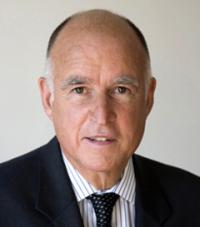

SACRAMENTO - Attorney General Edmund G. Brown Jr. today launched an

investigation aimed at protecting the rights of the "forgotten victims"

of the housing market collapse -- the tens of thousands of tenants

facing eviction from buildings that have been foreclosed by banks.

"Tenants who live in properties in foreclosure are the forgotten

victims of the collapse of the housing market," Brown said. "We'll fight

every step of the way to ensure they aren't rousted from their homes in

violation of the law."

As a part of his investigation, Brown today sent letters to 24

banks, loan servicers, private investors, and law firms demanding

information about whether they are complying with federal, state, and

local laws regarding foreclosed properties and their treatment of

tenants.

More than 20 housing rights and public interest groups from across

California have petitioned the Attorney General to take action, citing a

"pattern of illegal conduct" and tenant harassment by banks, real

estate agents and lawyers attempting to speed up evictions so that

foreclosed properties can be sold.

More than one-third of all California residential units in

foreclosure are rentals, according to tenants' rights groups, and more

than 200,000 California tenants have been uprooted from their homes

during the housing crisis.

Since March 2009, Tenants Together, a statewide tenants' rights

organization, has assisted 3,000 tenants involved in foreclosures. The

group cited many examples of abusive tactics by banks and their

representatives in foreclosure situations, including intimidation,

threats and misrepresentations. One case involved a Chula Vista tenant

who found a chilling letter posted on his door indicating the property

was "being monitored." A Dublin tenant found a note on his door saying

the locks on his unit had been changed and giving a contact if he wished

to claim "personal property" left inside.

In his letter, Brown requires banks, loan servicers, private

investors and law firms to provide information by July 19 about their

policies and procedures when dealing with foreclosed properties and

current tenants. It specifically asks the recipients to outline how they

"promote or preserve tenancies after foreclosure".

In May 2009, the federal government enacted the "Protecting Tenants

at Foreclosure Act" giving tenants new protections, such as the right to

stay in their homes for at least 90 days after receiving an eviction

notice. While state and local laws also contain strong protections,

unlawful evictions and harassment of tenants continue.

Tenants should know their rights under the law. These rights

include:

- Tenants cannot be required to move out of their homes for at least

90 days following an eviction notice.

- Tenants can insist on staying until the end of their leases. The

only exception occurs when the new owner of a single-family home wants

to move in.

- Tenants can require banks and their agents to put all

communication in writing.

- Tenants are not obliged to accept "cash for keys" money to move

out sooner than the law prescribes.

- Harassment, such as improper entry into a person's home, shutting

off water and lights, or changing the locks without a court order is

illegal.

- The above rights extend to tenants living in government-subsidized

Section 8 housing, who may also have additional protections under state

and local laws.

- If a city has a just cause for eviction law, a landlord must have a

specific reason to evict a tenant, and foreclosure may not be

recognized as a legitimate basis for eviction. Tenants should check

local ordinances.

Sixteen cities in California have just cause for eviction

ordinances: Berkeley, Beverly Hills, East Palo Alto, Glendale, Hayward,

Los Angeles, Maywood, Oakland, Palm Springs, Richmond, Ridgecrest, San

Diego, San Francisco, Santa Monica, Thousand Oaks, and West Hollywood.

Brown's office has fought for Californians' rights during the

housing crisis by shutting down loan modification scams and other

illegal mortgage practices. To learn more about these actions, visit: http://ag.ca.gov/loanmod/.

If you think your rights as a tenant have been violated and want to

file a complaint, contact the Attorney General's Public Inquiry Unit at

http://ag.ca.gov/consumers/general.php.

Brown's letter, sent today, is copied below:

Re: Protecting the Rights of Tenants Residing in Foreclosed Property

Dear Sir or Madam:

California is facing an unprecedented threat to its economy because

of skyrocketing residential property foreclosures. As the foreclosure

crisis continues to plague California homeowners, renters in foreclosed

properties have become innocent victims of the crisis. It is estimated

that more than one third of all California residential units in

foreclosure are rentals. Once a rental property goes into foreclosure,

renters may face a multitude of problems, including utility shutoffs,

lockouts, and unlawful evictions. The Office of the Attorney General

has learned of numerous instances where tenants have reported harassment

and misconduct by realtors, brokers, and landlords, as well as improper

attempts to evict them from their homes by eviction law firms.

The recently enacted Protecting Tenants at Foreclosure Act (PTFA)

grants certain protections for tenants residing in foreclosed property,

including the right to continue living in the premises for the duration

of their lease, and the right to a 90-day eviction notice when there is

no lease. State and local laws also provide specific protections for

tenants residing in foreclosed property. We are concerned about the

increasing number of tenant evictions without compliance with federal

and state law. Given the importance of this issue, we ask that you

provide the following information by July 19:

1. What policies and procedures do you have that promote or preserve

tenancies after foreclosure?

2. What process do you use for determining whether a residential

property is owner or renter occupied?

3. When it is determined that a renter occupies the residential

property, do you notify the occupant that a Notice of Default has been

filed? If so, what notice do you provide?

4. What procedures do you use to notify tenants in advance of the

trustee sale? Please furnish a sample copy of a Notice of Sale and the

specific language advising renters of their rights.

5. How do you notify tenants that you are the new owner of the

property following the trustee sale? Please furnish a sample copy of

any such letter or notice and the specific language advising renters of

their rights.

6. Once it is determined that the foreclosed property is renter

occupied, how do you determine whether renters are protected under the

PTFA and/or local rent control ordinances?

7. What policies or guidelines are in place for your contractors,

agents or property managers when it has been determined that a

foreclosed property is tenant occupied? Do you have any policies that

call for the properties to be vacated in order to prepare them for sale?

Are your contractors, agents or property managers given any monetary

compensation or other incentives if the properties are vacated?

a. Please furnish an example of any written contracts, agreements,

or memoranda of understanding that you have with your contractors,

agents or property managers.

b. Please furnish copies of any written policies, procedures, or

guidelines advising rental agents or property managers about renters'

rights.

c. Please furnish copies of any written contracts, guidelines,

policies, or procedures relating to any "cash-for-keys" incentives

offered to occupants.

8. What steps are taken when a rental agent or property manager does

not comply with those policies, procedures, or guidelines as described

above?

9. Which California attorneys or law firms do you retain for the

purpose of terminating a tenancy or bringing eviction proceedings

against occupant renters?

10. Please furnish us with the following information regarding

California properties that you obtained through foreclosure since

January 1, 2009:

a. The number of foreclosures of single family homes, condominiums,

and multi- unit rental property that resulted in you becoming the new

owner or successor in interest.

b. Of the foreclosed properties described in subparagraph a. above,

the number of tenant termination notices or unlawful detainer evictions

you filed against the remaining occupants. Please include the name of

the occupants, the property address, the date of the trustee sale, and

the date that any unlawful detainer was filed against the occupants of

the foreclosed property.

c. The number of foreclosures of elderly residential-care facilities

that resulted in you becoming the new owner or successor in interest.

These residential-care facilities include assisted living facilities,

skilled nursing homes, group homes, and intermediate care facilities.

d. Of the foreclosed properties described in subparagraph c. above,

the number of tenant termination notices or unlawful detainer evictions

you filed against the remaining occupants. Please include the names of

occupants, the property address, the date of the trustee sale, and the

date that any unlawful detainer was filed against the occupants of the

foreclosed property.

We look forward to receiving the requested information and also

welcome any suggestions you may have to help eliminate these and other

problems facing renters occupying properties in foreclosure.