The following webpage and resources have been developed by staff with years of experience in tenants' rights, but they DO NOT substitute for legal advice.

Facing eviction or threats of eviction? You are NOT alone! DO NOT LEAVE your home until you have learned about your rights as a tenant! Let this knowledge give you the power to stay housed! Fear makes us weaker, but rights and community make us MUCH stronger!

If your landlord is attempting to evict you WITHOUT a court order (court order documents use words like “summons,” “complaint” and “unlawful detainer”), STAY IN YOUR HOME. All evictions must proceed through the courts. Following a court decision, the ONLY person that can physically remove you from your home is the sheriff, not the landlord.

Related Eviction Topics

Know Your Rights in Housing - Evictions

Download your own copy of "Know Your Rights - Evictions" HERE and share with anyone you know who might need support!

Download your own copy of "COVID-19 Related Tenant Protections for Not Paying Rent" HERE share with anyone you know who might need support!

What eviction protections exist AFTER April 1st, 2022 if I still can’t pay rent?

TENANTS DO NOT NEED TO IMMEDIATELY LEAVE THEIR HOME WHEN THEY RECEIVE AN EVICTION NOTICE.

After April 1st, 2022, eviction protections for not paying rent will depend on if you have applied to the Emergency Rental Assistance Program (ERAP) and the current application status. If you still have more questions about ERAP, go to our ERAP webpage here.

My landlord gave me a 3-day eviction notice for not paying rent. What should I do to prevent being evicted?

If you receive a written eviction notice for not paying rent, complete the following steps as SOON as possible.

-

If you applied to ERAP, inform your landlord in writing and send via certified mail include the months and amount of rent you have applied for on the ERAP application. Use Tenant Together's sample letter to inform your landlord of pending ERAP application at bit.ly/pending-erap-letter.

- Take a picture of the document before you turn it in to save a copy for your own records.

-

Save ALL documentation of the eviction notice and communication with your landlord – this includes text messages, emails, receipts of any months of rent paid, and other letters you might receive regarding the rent debt!

- Keep evidence of landlord intimidation, discrimination or harassment if it is happening!

What types of protections exist for other types of evictions?

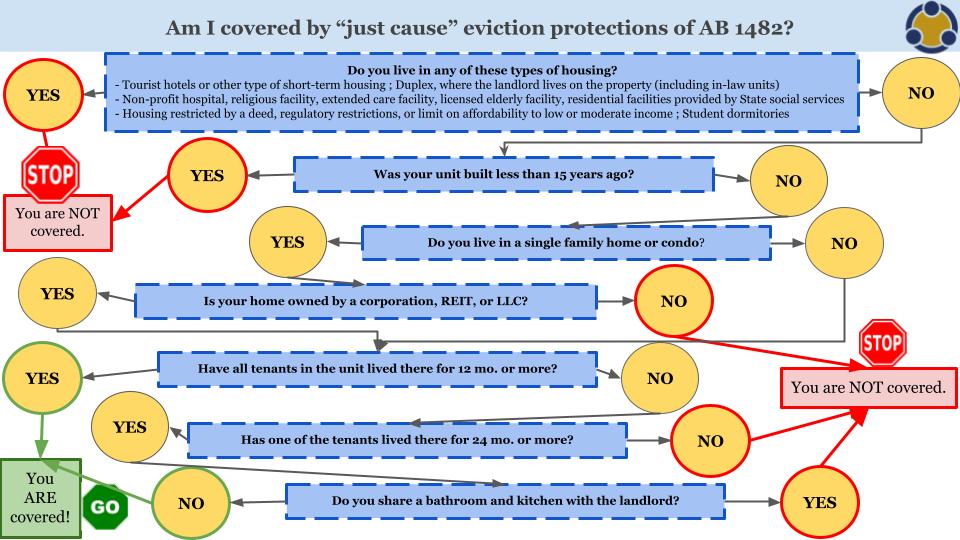

After April 1, 2022, only SOME California tenants are covered by statewide just cause eviction protections. “Just cause eviction protections” prevent unfair evictions by limiting the reasons your landlord can evict covered tenants. Landlords must state an allowable “just cause” reason on the written eviction notice to a tenant for it to be valid.

Ask yourself these questions to find out if you are covered by statewide just cause protections!

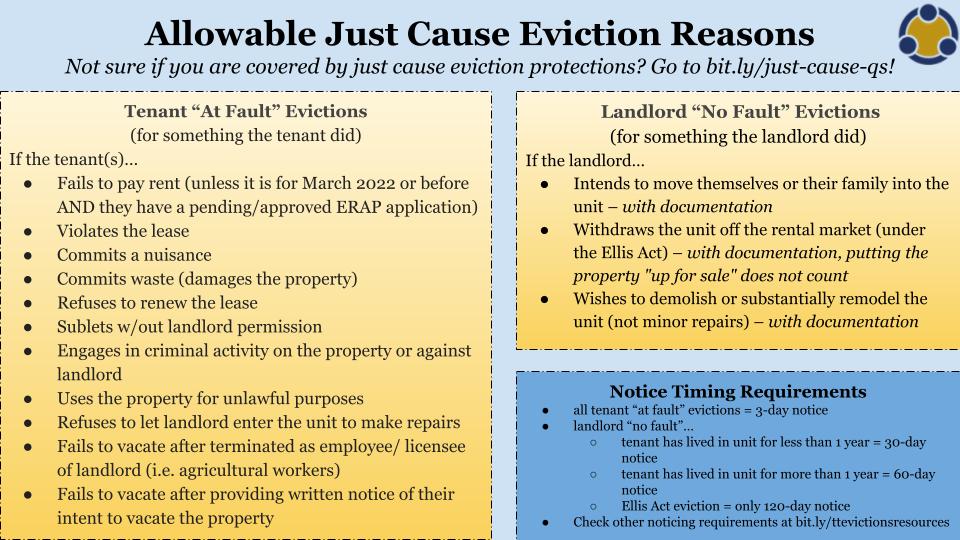

- If you ARE covered by statewide just cause, you can only be evicted for certain reasons, listed in "Allowable Just Cause Reasons" below!

-

If you are NOT covered by statewide just cause, you may be covered by local just cause depending on where you live.

- To find out if you are covered by these local protections, please contact legal aid by searching by your county at bit.ly/local-tenant-help.

NOTE: “Selling the property” is NEVER a valid just cause eviction reason UNLESS the property will be converted into something that will no longer be used for rental housing, such as a community center (because it must actually be “removed from the rental market” to be a valid Ellis Act eviction). Changing owners is NOT enough!

- If you receive an eviction notice, respond to the landlord with this letter.

What is going to happen with the overdue COVID-19 rent (months of March 2020 to March 2022)?

Your landlord CAN...

-

For months of March 2020 to September 2021...

-

Decide to take you to small claims or superior court (NOT eviction court) to recover overdue COVID-19 rent.

- The rent debt will be converted to a consumer debt, meaning that this unpaid rent can NEVER be used as a reason for eviction, but MAY affect your credit scores depending on the outcome of the court.

-

Sell your overdue COVID-19 rent debt to a collection agency ONLY IF you do NOT meet the requirements of the Emergency Rental Assistance Program (ERAP).

- If you do meet those requirements, it can NEVER be sold to a collection agency!

-

Decide to take you to small claims or superior court (NOT eviction court) to recover overdue COVID-19 rent.

-

For the months of September 2021 to March 2022...

- Decide to take you to eviction court to recover overdue COVID-19 rent.

Your landlord CANNOT...

-

Evict you outside of the court process, even if they call the police.

- This is known as an illegal lockout. The only person that can physically remove you from your home is the SHERIFF.

- Impose a late payment fee on your unpaid rent.

- Use your security deposit towards unpaid rent.

- Use unpaid rent as a negative factor for refusing to rent to an otherwise qualified tenant.

Eviction Resources for Tenants

- California Courts' Eviction Self-Help Guide

-

Sample Letters to Document Communication with Landlords

- If you have received an eviction notice, see the “Evictions” section.

- If you are experiencing harassment or discrimination either before or after asserting your rights, you are NOT alone! See the “Harassment/Retaliation” section.

- Housing Protections for Domestic Violence Survivors