Hagale clic aquí para leer esta página web en español.

To learn more about the status of the Statewide Emergency Rental Assistance Program please review Public Counsel FAQ in your preferred language https://publiccounsel.org/ca-rent-relief/

Tenants Together partners including Public Counsel, SAJE, Policy Link, Western Center on Law & Poverty, ACCE, Legal Aid Foundation of Los Angles, and Covington & Burling LLP were successful cuing the CA Dept of Housing Community & Development operation of the Housing Is Key COVID-19 Emergency Rental Assistance Program

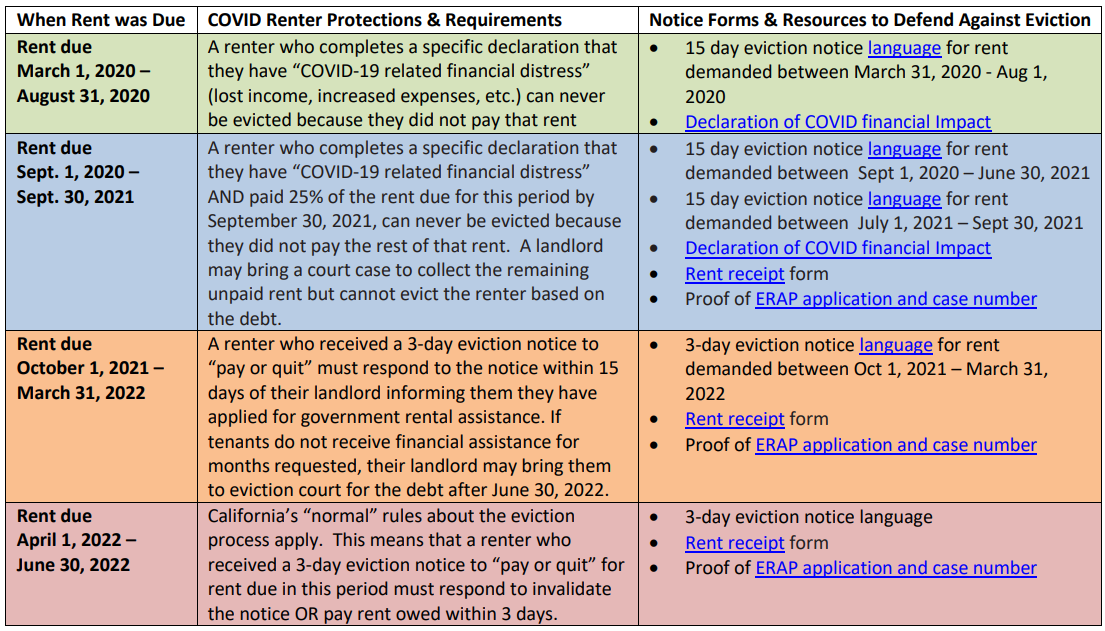

What eviction protections still exist if I have rent debt due to COVID?

- The statewide eviction protections for COVID rent payment ended September 30, 2021 (see visual below).

-

Tenants who continued to experience challenges to make rental payments due to COVID after September 30, 2021 could continue to apply for statewide Emergency Rental Assistance Program (ERAP) from October 1, 2021 – March 31, 2022

- Tenants who were actively applying to ERAP during October 1, 2021 – March 31, 2022, and received a 3 day “pay or quit” notice from their landlord must have responded within 15 days of receiving the eviction notice with proof of their ERAP application and case number.

-

Rent due during April 1, 2022 – June 30, 2022:

- California normal rules about the eviction process applied. This means that a renter who received a 3-day eviction notice to “pay or quit” for rent due is in this period must respond to invalidate the notice OR pay rent owed within 3 days.

- There are very few local jurisdictions that have remaining COVID eviction moratorium. Please review LegalFAQ.org to see if you are eligible for local COVID eviction protections.

How will I be informed about the status of my ERAP application?

-

Make sure that your contact information is up to date on your ERAP application:

- Email address

- Mailing address

- Any 3rd party or other person the tenant listed in their application who helped them apply

-

Monitor the status of your ERAP application regularly on the application portal here

-

If you are having trouble accessing your application through the application portal, you should contact:

- Housing Is Key Call Center: 833-430-2122

- Local Partner Network: 833-687-0967

-

If you are having trouble accessing your application through the application portal, you should contact:

Which tenants are covered by this ERAP settlment?

- Any tenant who applied to ERAP on or before March 31, 2022 AND still has a pending application or was denied on or after June 7, 2022 .

- Only for statewide ERAP – does not apply to local rental assistance programs run by a city or county

- Does NOT re-open the ERAP program to new applications

How do I appeal denied or partial approval status on my ERAP application that I received since June 7, 2022?

- Appeals process is now EXTENDED! Tenants have 30 days to appeal, or if not the denial notice will be considered final

- Portal will automatically open an appeals process on ERAP applications that retroactively received a partial denial, who were denied for “partial approval notice”

-

Tenants can use email or phone to start an appeal

- Email: Appeal@ca-rentrelief.com

- Phone: 833-430-2122

- Directly through the portal